child care tax credit portal

Democrats beefed up the child tax credit to a maximum of 3600 for each child up to age 6 and 3000 for each one ages 6 through 17 as part of the American. The credit amount was increased for 2021.

Usa Finance And Payments Live Updates Gas Stimulus Check Tax Deadline Child Tax Credit Portal Tax Refunds As Usa

600 in December 2020January 2021.

. That means that instead of receiving monthly payments of. This means that instead of receiving monthly payments of say 300 for your 4-year. At first glance the steps to request a payment trace can look daunting.

If you got advance payments of the CTC in 2021 file a tax. 1400 in March 2021. Parents income matters too.

In the year 2021 following the passage of the American Rescue Plan Act of 2021 it was temporarily raised to 3600 per child. Parents and relative caregivers can get up to 3600 per child for tax year 2021 from the new CTC. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

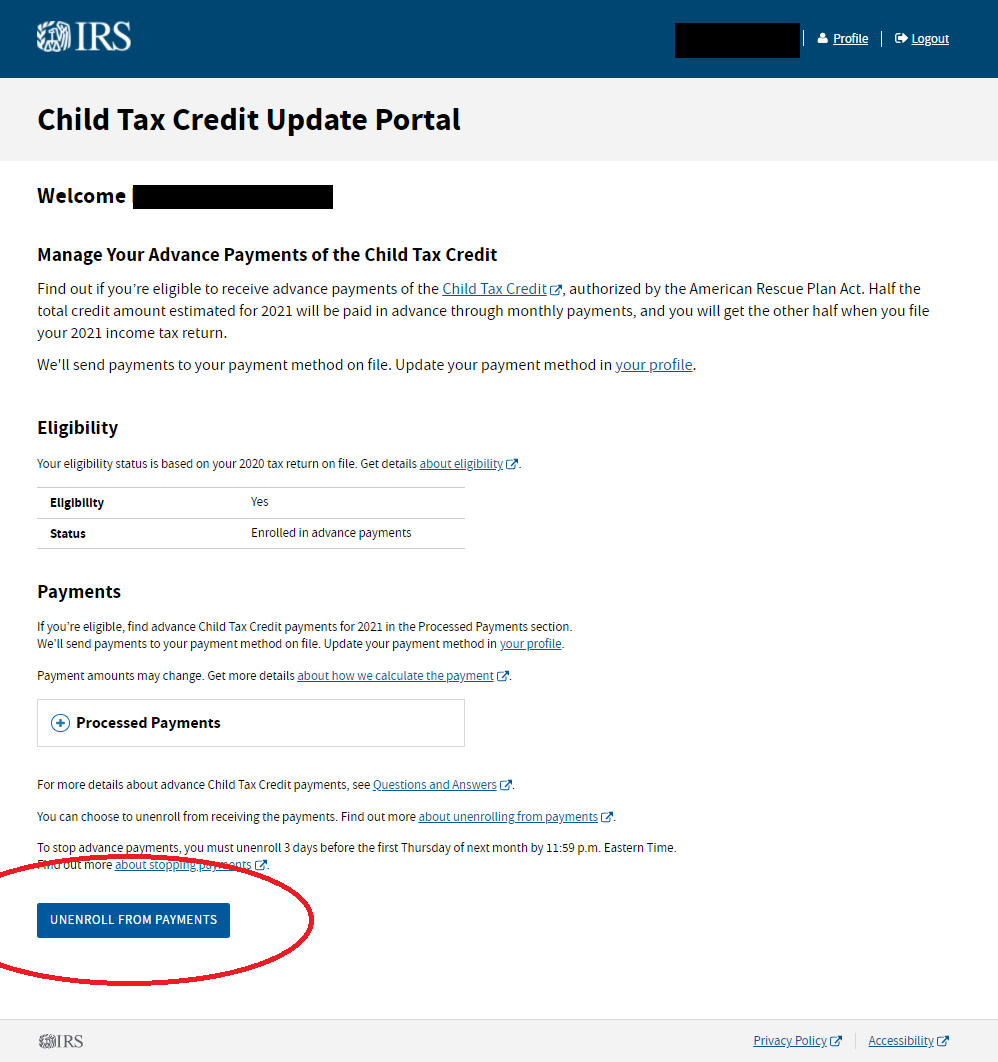

The Child Tax Credit Update Portal now lets you opt out of receiving this years monthly child tax credit payments. File a 2021 tax return by April 18 2022 to claim the CTC for 2021. The Child Tax Credit helps all families succeed.

When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund. Get your advance payments total and number of qualifying children in your online account. Distributing families eligible credit through monthly checks for.

The Child Tax Credit CTC provides financial support to families to help raise their children. Not everyone is required to file taxes. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The credit was made fully refundable. The rest of your Child Tax Credit will be issued in one payment. A childs age determines the amount.

Bigger child tax credit for 2021. By making the Child Tax Credit fully refundable low- income households will be. The American Rescue Plan enacted in last March increased the tax break to 3000 from 2000 per child under age 17 with 600 more for kids under age 6.

To apply visit portalctgovDRS and. To reconcile advance payments on your 2021 return. This year Americans were only required to file taxes if they.

You do not need to have a job or income to claim this credit. Government made changes to the CTC for tax year 2021. To help families during the COVID-19 pandemic the US.

You can check eligibility requirements for stimulus. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. Good news Child Care Relief Funding 2022 is here.

Dear Connecticut Resident Thanks to a new federal law the American Rescue Plan most families in Connecticut with children under 18 are now eligible to receive Child Tax Credit payments of between 250 to 300 per month per child or up to 3600 per child per year. Youll need to print and mail the. On October 19 2021 the Texas Workforce Commission TWC approved distribution of 245 billion American Rescue Plan Act funds for direct relief to child care programsOn February 1 2022 the Commission dedicated an additional 1 billion of COVID stimulus funding to the 2022 CCRF bringing the total.

1200 in April 2020. The Families First Coronavirus Response Leave Act FFCRA can help most businesses even those with only one owneremployee to get compensation for time off because of COVID quarantine and taking care of children out of school. The federal Child and Dependent Care Credit helps families pay for child care for children under age 13 or for care of dependent adults.

The Child Tax Credit provides money to support American families helping them make ends meet. Families eligible for the expanded Child Tax Credit CTC dont have to wait until they file their taxes in 2022 to start getting payments. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently.

You will get half of this money in 2021 as an advance payment and the other half in 2022 when you file a tax return. The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent childrenIt provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and phase-in. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Enter your information on Schedule 8812 Form. Millions of families received upfront. Check mailed to a foreign address.

The Child Tax Credit CTC is a federal credit that helps families afford the everyday expenses of raising a child. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. If you have not received any Child.

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. Anyone interested in seeking a rebate must apply to the Connecticut Department of Revenue Services.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. The Employee Retention Tax Credit ERTC is a great opportunity for child care businesses with W-2 employees. If you got advance payments of the CTC in 2021 file a tax.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18.

Families were eligible to get half of their CTC as advance monthly payments from July to December 2021 and the other. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file taxes this year to get the second half of your money. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000.

White House Unveils Updated Child Tax Credit Portal For Eligible Families

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

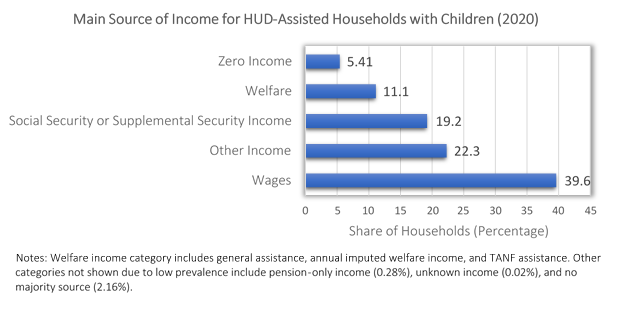

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

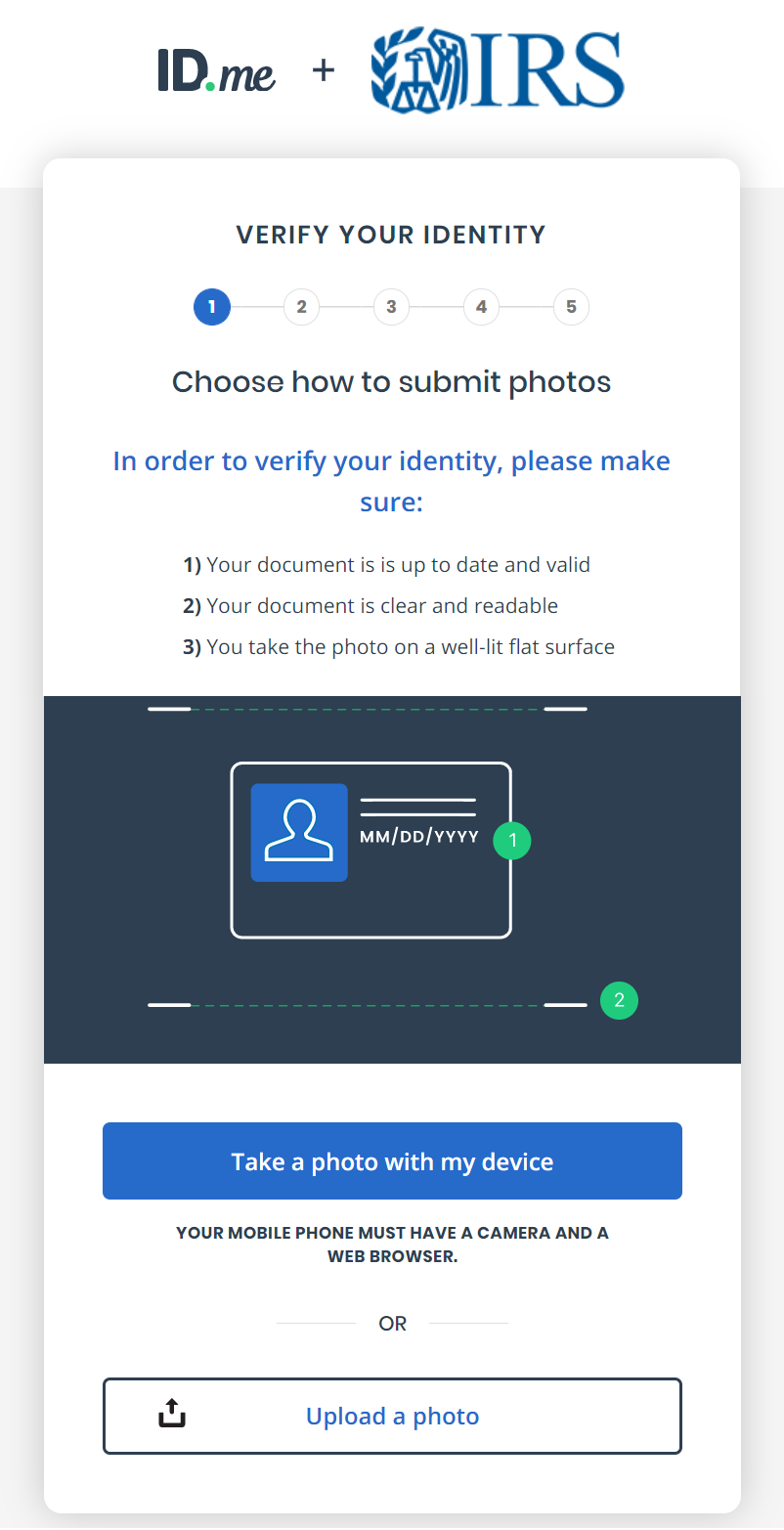

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Missing A Child Tax Credit Payment Here S How To Track It Cnet

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit 2022 Update 750 Payments Available To Americans But You Have To Apply Soon Deadline Date Revealed

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back